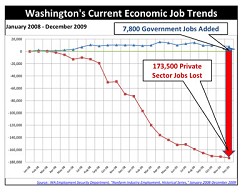

Source: Employment SecurityA graph illustrating the loss of jobs in the private sector while jobs in government have continued to rise.

I recently hosted a community call in our legislative district. Thousands of constituents participated and, as I suspected, jobs and the economy and taxes and spending were the top issues facing our communities. During the call, I asked participants how they would prefer to solve the $2.7 billion budget shortfall. Here are the results:

• 74 percent support no tax increases with more cuts to government;

• 4 percent support an increase in taxes with minimal or no cuts to government;

• 16 percent support a combination of tax increases and moderate cuts to government; and

• 6 percent are not sure how to solve the budget shortfall.

I will not support any new taxes on citizens, including employers. Employers and families are making tough budget decisions, and government should do the same. I continue to believe it is past-time for state leaders to set spending priorities based on the core functions of government: education, public safety and services that aid our most vulnerable citizens.

The only way to get our state and nation out of this recession is through private-sector job growth. Making sure our employers are confident their taxes will not be raised and regulations will be reduced, will put people back to work.

Unfortunately, I recently confirmed what I already assumed to be true – big-government advocates do not like the idea of slimming down. As part of my effort to get a clearer look at the employment situation and government spending in Washington, I asked staff to dig into job numbers provided by the state Employment Security Department over the past year. What I found was more shocking than I imagined.

According to the department’s reports, from January 2008 through December 2009, more than 173,500 folks in the private sector lost their jobs. Meanwhile, government at all levels grew by more than 7,800 jobs! Folks, I am the same guy you have elected since 2002, and I do not believe that growing government is meaningful economic development. We do need staff in our schools and our fire and police stations, but if there is one sure-fire way to guarantee higher taxes on individuals and employers, it is allowing government to grow out of control.

Once budget writers commit to larger government bureaucracies, they commit taxpayers to fund them forever. It’s not right and it is unsustainable. That’s why the majority Democrats are attempting to snub voters and raise taxes by passing Senate Bill 6130, which would suspend Initiative 960.

The 2007 voter-approved I-960 requires a two-thirds vote of the Legislature, or a vote of the people, to raise taxes. The people have approved this same tax-hike safeguard three times in the past. They knew exactly what they were doing when they cast their ballots in support of tax-limiting measures. There seems to be a mentality by some in Olympia that, “you don’t know what you want – we know better.”

This attitude is arrogant and wrong. We cannot tax our way out of this recession – private sector jobs are the key to turning our economy around.

This is your government - you elect me to represent you, not to rule over you and that’s why I respect your opinions. I encourage you to call the governor and the Speaker of the House and let them know your thoughts about SB 6130, which would repeal I-960. Their contact information is as follows:

• Governor Christine Gregoire: (360) 902-4111

• Speaker of the House Frank Chopp: (360) 786-7920

We don’t need higher taxes or more government spending, and we certainly do not need the tax-and-spenders reaching deeper into our wallets. We need employers to feel secure so they will begin to hire again. This government is of, by and for the people, so make your voice heard on this important issue. As always, I represent you and my door is always open. I can be reached at (360) 786-7988 or kretz.joel@leg.wa.gov.

Rep. Joel Kretz, R-Wauconda, serves as deputy leader for the House Republicans. He represents the 7th Legislative District, which includes Ferry, Stevens, Pend Oreille, Lincoln and parts of Okanogan and Spokane counties.