Labor Statistics

None of my columns has stirred quite as much reaction as my recent comments regarding our “overpaid state employees” and their “growing and unsustainable wages and benefits.” Of course most of the respondents were unwilling to “go on the record” with their comments. They simply wanted to let me know that my opinion was not based on fact and that it was just another example of the useless ramblings of a greedy and selfish business owner.

One writer provided me with a chart of state employee wages compared to other local Washington state agencies and private employers. He also included a copy of a story that ran in The Olympian newspaper last May. The headline of that story was, “State workers still earn less.” I’m sure the headline sold well in Olympia. Problem is the story was about a study conducted by a company that specializes in public sector compensation and benefits. In fact the study was conducted for the state human resources department at a cost of $147,000. I can only wonder if my liberal critic actually read the story since the story included this one very inconvenient fact: In 2008 average pay for state employees was $49,906 while the statewide average for all non-farm workers was only $46,562 according to the Washington State Employment Security Department.

My conclusion from reading the Olympian article is that the state paid $147,000 to an outside consultant to find information that would support their predetermined opinion and give them data to support raises. While information that was readily available from state employer tax reports clearly indicate a different conclusion.

But like all government spending issues, the problem gets much worse. The ESD data is only direct wages. It does not include employee benefit costs like health and pensions. Nearly everyone agrees that state employee benefit programs are richer than their private sector counterparts but so far efforts by legislators like Republican Sen. Joe Zarelli to push for higher worker contributions to their health care have been unsuccessful. And public sector employees are still covered by expensive fixed benefit pension plans while private sector employees participate in their retirement through savings plans like 401k programs. Add the cost of these “rich” benefit programs to the total compensation of state employees and the disparity between private sector and public sector compensation becomes even more dramatic.

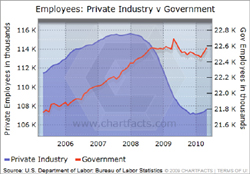

According to the U.S. Bureau of Labor Statistics (BLS), from 1998 to 2008 public employee compensation grew by 28.6 percent, compared with 19.3 percent for private workers. And by 2008, public sector employees were earning 45 percent more than private sector workers. Most of that 45 percent can be traced to the fact that government employee benefits are 70 percent higher than those provided by private sector employers. According to The Wall Street Journal if government employees earned the average of private sector employees, states and local governments could save $339 billion – enough to erase the current combined deficits of all of the states.

And if all of the above is not enough, a 2009 study by economists Robert Novy-Marx and Joshua Rauh, published in the Journal of Economic Perspectives, estimated that government pensions are underfunded by $3.2 trillion. That means every American household is on the hook for $27,000 to pay for promises made by politicians to pay for the retirement of our public sector employees.

Now don’t get me wrong. I am not saying that public employees do not deserve to make a “living wage.” But they have no special right to earn more than those who work hard to provide that living. And in a difficult economy like the one we are currently facing, legislators cannot realistically balance the budget without addressing the imbalance that currently exists. By the state’s own numbers the average state employee is earning 7 percent more than private sector employees. Cutting state employee pay 5 percent would save the state approximately $350 million. And addressing cost sharing of employee benefit costs could probably add another $150 million.

It would be a painful cut for many state employees but much easier than cutting 5-10 percent of the workforce in order to save the state the same amount of money. And of course, if you want to follow the standard liberal agenda that the wealthy should contribute more then the pay cut would be made progressively with the highest paid employees taking a larger cut than the lower paid employees. But I doubt Democrats could be that progressive!